2024 ACA Reporting: Forms, Instructions & Deadlines

Posted on January 9, 2024

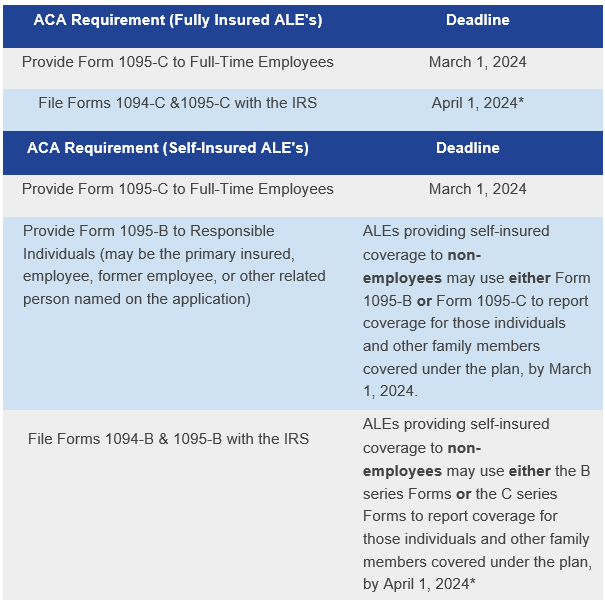

The Affordable Care Act requires applicable large employers (ALEs) – generally those with 50 or more full-time employees – to report information to the IRS and to their full-time employees about their compliance with the employer shared responsibility (pay or play) provisions and the health care coverage they have offered (or did not offer).

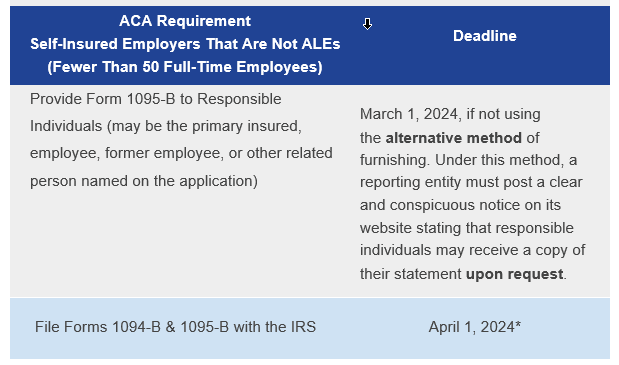

Self-insured employers (regardless of size) have additional reporting responsibilities that apply to health coverage providers.

Forms & Instructions

The following Internal Revenue Service (IRS) forms and instructions are available for 2023 calendar year reporting:

- Large Employer Reporting (Section 6056)

- Form 1094-C and Form 1095-C (and instructions)

- Minimum Essential Coverage (MEC) Reporting (Section 6055)

- Form 1094-B and Form 1095-B (and instructions)

2024 filing deadlines for 2023 coverage are as follows: