Horizon Brief Notes: Grandmothering Extended Into 2023 for Pre-ACA Plans

Posted on July 7, 2022

Groups of six to 44 eligible employees do not need to submit tax documents. Instead, these groups need to submit the Certification with Conversion form and waivers.

If a group accepts its existing pre-ACA or ACA plan renewal, no paperwork is necessary. Conversion paperwork is only required if a group converts to a different ACA plan alternative or if the group moves from a pre-ACA plan to an ACA plan.

The conversion deadline for renewing groups or off-anniversary conversions is five business days prior to the renewal date. Complete paperwork must be submitted in a timely manner. Incomplete paperwork may cause the group to lose their requested conversion date.

Conversion paperwork must be emailed to Conversion@HorizonBlue.com

Certification Paperwork Submission

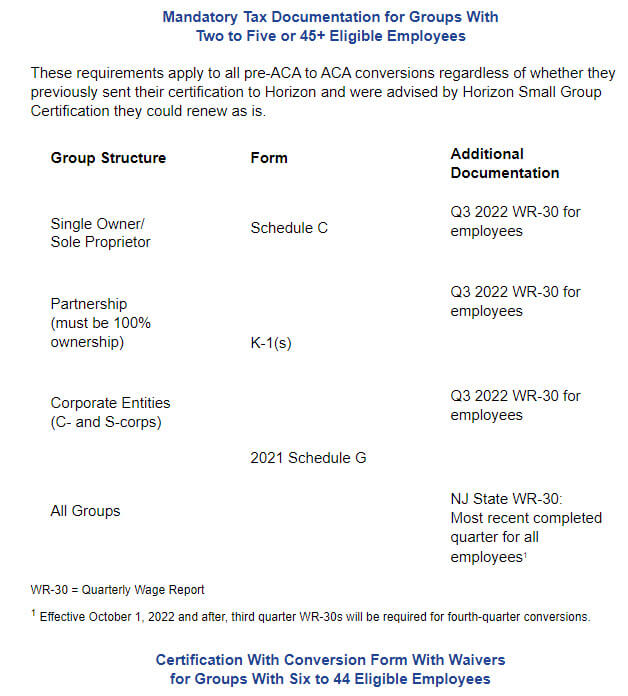

New certification paperwork, including waivers and tax documents as outlined above, is required with the conversion paperwork for groups of two to five and 45 or more eligible employees when converting from pre-ACA to ACA plans. This helps us ensure that husband/wife, sole proprietor and owner-only enrolled groups are renewing as is in their pre-ACA plans and are not converting to an ACA plan; these groups are not eligible for ACA plans.

Horizon sends certification paperwork at least 120 days prior to a group’s renewal. Groups are instructed to complete and return the paperwork to Horizon within 15 days of receipt. At that time, the group will not have received its renewal to decide to renew into the existing pre-ACA plan or move to an ACA plan.